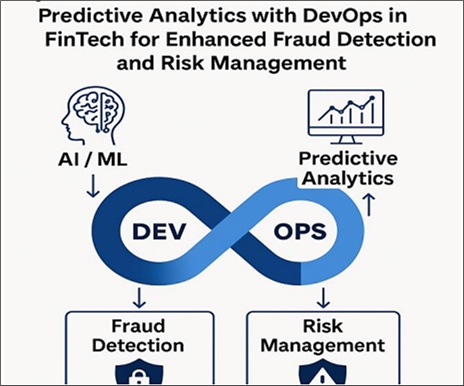

Integration of AI/ML and Predictive Analytics with DevOps in FinTech for Enhanced Fraud Detection and Risk Management

DOI:

https://doi.org/10.26438/ijcse/v13i6.3238Keywords:

Cybersecurity, DevOps, AI, ML, Risk Management in FinTech, a, and Prevention of FraudAbstract

Financial technology has transformed the provision of financial services with the aid of artificial intelligence?(AI), machine learning (ML) as well as predicting analytics. Agility, scalability, and agility definitely are the focus for financial?applications needs as the FinTech world picks up globally. As a result of the fusion of AI/ML algorithms?with DevOps methodologies, the operability has been accelerated, and the decision-making has been enhanced. DevOps ensures faster, trustworthy software development and deployment while AI and ML enable Fintech apps to process enormous amounts?of data and improve the accuracy of predictive modeling. One of the key components of artificial intelligence (AI) lies in predictive analytics to assist in?the real-time trend prediction, customer behaviours analysis and risk management. Predictive analytics enhances inventory prediction, market forecasting, fraud detection &?credit risk calculation efficiency with historical data & complex formulae. Sitting alongside this ecosystem, DevOps facilitates better communication and collaboration between operations and development teams -- to help streamline?integration processes and promote the ability to iterate AI and ML models more frequently. When organizations use DevOps?practices—they’re able to adapt to new market demand faster and to changes in regulatory requirements in a timelier manner, financial institutions find, because these approaches automate processes and improve system stability. This?makes it easy to take your predictive models live. Moreover, DevOps depends on consumption-based cloud-native infrastructure which allows ease of scaling, which comes in handy since FinTech apps are built on data handling and analysis in?real-time. We explore the impact of AI/ML and predictive analytics and discuss the wins, the downfalls and?emerging trends and potential developments that could impact the financial services sector in the future.

References

[1] W. O. Kermack and A. G. McKendrick, “A Contribution to the Mathematical Theory of Epidemics,” J. R. Soc. Lond., Vol.115, pp.700–721, 1927.

[2] D. O’Neill et al., “Credit Scoring Using Machine Learning,” J. Financ. Serv. Res., Vol.45, No.3, pp.89–102, 2014.

[3] P. Buhlmann et al., “Integrating Non-Traditional Data Sources into Credit Risk Models,” J. Risk Financ. Manag., Vol.11, No.2, pp.85, 2018.

[4] S. Jorfi et al., “Machine Learning in Credit Scoring: A Review,” Expert Syst. Appl., Vol.130, pp.306–317, 2020.

[5] P. Leite et al., “DevOps in Financial Services: A Review and Applications,” Financ. Innov., Vol.2, No.1, pp.12, 2016.

[6] M. Bachmann et al., “Enhancing Fraud Detection in Financial Institutions Using Deep Learning,” J. Financ. Fraud Detect., Vol.3, No.4, pp.189–202, 2019.

[7] Z. Liu et al., “The Role of Cloud-Native Architectures in Fraud Detection,” IEEE Access, Vol.9, pp.25150–25160, 2021.

[8] J. Elder et al., “Cloud-Native Technologies for Financial Services: Opportunities and Challenges,” Financ. Technol. J., Vol.15, No.3, pp.102–113, 2020.

[9] T. Schmidt et al., “Leveraging Cloud Computing for Real-Time Fraud Detection,” J. Financ. Syst., Vol.8, No.5, pp.445–457, 2020.

[10] B. Marr, “Cloud-Native Solutions for Financial Services: Ensuring Security and Compliance,” Cloud Comput. Finance, Vol.6, No.2, pp.98–104, 2021.

[11] M. Liu et al., “Predictive Analytics in Financial Risk Management: A Machine Learning Approach,” J. Financ. Eng., Vol.12, No.1, pp.23–39, 2021.

[12] G. Kovacs et al., “Cloud-Native Applications in Credit Risk Assessment,” Int. J. Financ. Eng., Vol.16, No.4, pp.51–67, 2019.

Downloads

Published

How to Cite

Issue

Section

License

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors contributing to this journal agree to publish their articles under the Creative Commons Attribution 4.0 International License, allowing third parties to share their work (copy, distribute, transmit) and to adapt it, under the condition that the authors are given credit and that in the event of reuse or distribution, the terms of this license are made clear.