Survey on Machine Learning Techniques for Stock Market Prediction: Models, Challenges, and Future Directions

DOI:

https://doi.org/10.26438/ijcse/v13i5.2634Keywords:

Stock Market Prediction,, Machine Learning,, Deep Learning, Sentiment Analysis, Optimiz ation AlgorithmsAbstract

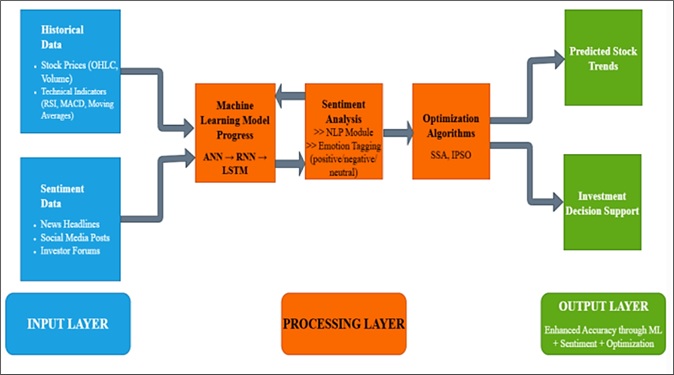

The stock market significantly impacts the global economy by shaping investment choices and contributing to financial stability. However, its dynamic, volatile, and non-linear nature makes stock price prediction a challenging yet essential task for investors, analysts, and researchers. Traditional forecasting methods, such as fundamental and technical analysis, often fail to capture complex market patterns. Recently, Machine Learning (ML) techniques have demonstrated effectiveness in forecasting stock prices by analyzing historical data and identifying intricate trends. This survey provides a comprehensive review of various ML models, including Artificial Neural Networks (ANNs), Recurrent Neural Networks (RNNs), Long Short-Term Memory (LSTM) networks, and hybrid approaches, highlighting their effectiveness in stock market forecasting. Additionally, it explores the role of sentiment analysis in price prediction, as financial news, social media, and investor sentiment significantly influence market movements. The paper discusses key challenges, optimization strategies, and recent advancements in combining ML with sentiment analysis for enhanced predictive accuracy. By analyzing existing literature and identifying research gaps, this survey offers valuable insights into stock market prediction using machine learning.

References

[1] M. M. Rounaghi and F. N. Zadeh, “Investigation of market efficiency and financial stability between SP 500 and London stock exchange: Monthly and yearly forecasting of time series stock returns using ARMA model,” Phys. A, Stat. Mech. Appl., Vol.456, pp.10–21, 2016

[2] G. Bandyopadhyay, “Gold price forecasting using ARIMA model,” J. Adv. Manage. Sci., Vol.4, No.2, pp.117–121, 2016

[3] A. Hossain and M. Nasser, “Recurrent support and relevance vector machines-based model with application to forecasting volatility of financial returns,” J. Intell. Learn. Syst. Appl., Vol.3, No.4, pp.230–241, 2011

[4] J. Chai, J. Du, K. K. Lai, and Y. P. Lee, “A hybrid least square support vector machine model with parameters optimization for stock forecasting,” Math. Problems Eng., 2015.

[5] J. Borade, “Stock prediction and simulation of trade using support vector regression,” Int. J. Res. Eng. Technol., Vol.7, No.4, pp.52–57, 2018

[6] A. Murkute and T. Sarode, “Forecasting market price of stock using artificial neural network,” Int. J. Comput. Appl., Vol.124, No.12, pp.11–15, 2015

[7] A. H. Moghaddam, M. H. Moghaddam, and M. Esfandyari, “Stock market index prediction using artificial neural network,” J. Econ., Finance Administ. Sci., Vol.21, No.41, 2016

[8] M. Nabipour, P. Nayyeri, H. Jabani, A. Mosavi, E. Salwana, and S. Shahab, “Deep learning for stock market prediction,” Entropy, Vol.22, No.8, pp.840, 2020

[9] A.Sherstinsky,“Fundamentals of recurrent neural network (RNN) and long short-term memory (LSTM) network,” Phys. D, Nonlinear Phenomena, Art. no. 132306, Vol.404, 2020.

[10] G. Ding and L. Qin, “Study on the prediction of stock price based on the associated network model of LSTM,”Int.J.Mach.Learn.Cybern.,Vol.11, No.6, pp.1307–1317, 2019.

[11] Ji, A. W. Liew, and L. Yang,“A novel improved particle swarm optimization with long-short term memory hybrid model for stock indices forecast,” IEEE Access, Vol.9, pp.23660–23671, 2021.

[12] S. Hochreiter and J. Schmidhuber, “Long short-term memory,” Neural Comput., Vol.9, No.8, pp.1735–1780, 1997.

[13] V. Gupta and M. Ahmad, “Stock price trend prediction with long short term memory neural networks,” Int. J. Comput. Intell. Stud., Vol.8, No.4, pp.289, 2019.

[14] V. R. Madireddy, “Stock market prediction in BSE using long short-term memory (LSTM) algorithm,” Int. J. Innov. Res. Comput. Commun. Eng., Vol.6, No.1, pp.561–565, 2018

[15] C.R. Ko and H.-T. Chang, “LSTM-based sentiment analysis for stock price forecast,” PeerJ Comput. Sci., Vol.7, pp.408, 2021.

[16] Y. Li and Y. Pan, “A novel ensemble deep learning model for stock prediction based on stock prices and news,” Int. J. Data Sci. Anal., Vol.13, No.2, pp.139–149, 2021.

[17] C. Kearney and S. Liu, “Textual sentiment in finance: A Survey Of Methods and models,” Int. Rev. Financial Anal., Vol.33, pp.171–185, 2014.

[18] Y. Rao, J. Lei, L. Wenyin, Q. Li, and M. Chen, “Building emotional dictionary for sentiment analysis of online news,” WorldWideWeb,Vol.17, No.4, pp.723–742, 2013.

[19] T. Matsubara, R. Akita, and K. Uehara, “Stock price prediction by deep neural generative model of news articles,” IEICE Trans. Inf. Syst., Vol.E101.D, No.4, pp.901–908, 2018.

[20] Z. D. Aksehir and E. Kilic, “How to handle data imbalance and feature selection problems in CNN-based stock price forecasting,” IEEE Access, Vol.10, pp.31297–31305, 2022

[21] J. Xue and B. Shen, “A novel swarm intelligence optimization approach: Sparrow search algorithm,” Syst. Sci. Control Eng.,Vol.8, No.1, pp.22–34, 2020.

[22] A. Fathy, T. M. Alanazi, H. Rezk, and D. Yousri,“Optimal energy management of micro-grid using sparrow search algorithm,” Energy Rep., Vol.8, pp.758–773, 2022.

[23] Rohit Kumar, Rohit Gajbhiye, Isha Nikhar, Dyotak Thengdi, Sofia Pillai, “Stock Market Prediction using Deep Neural Networks,” International Journal of Computer Sciences and Engineering, Vol.7, Issue.4, pp.24-28, 2019.

[24] Rohit Tetarwal, Rohit Tushir, “Simulation Based Exploration of Stock Market Using LSTM Model ,” International Journal of Computer Sciences and Engineering, Vol.11, pp.26-29, 2023

Downloads

Published

How to Cite

Issue

Section

License

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors contributing to this journal agree to publish their articles under the Creative Commons Attribution 4.0 International License, allowing third parties to share their work (copy, distribute, transmit) and to adapt it, under the condition that the authors are given credit and that in the event of reuse or distribution, the terms of this license are made clear.