A Machine Learning Framework for Financial Fraud Detection Using Explainable Artificial Intelligence Techniques

DOI:

https://doi.org/10.26438/ijcse/v13i5.1725Keywords:

Fraud detection, Explainable Artificial Intelligence (XAI), SHAP, LIME, SMOTEAbstract

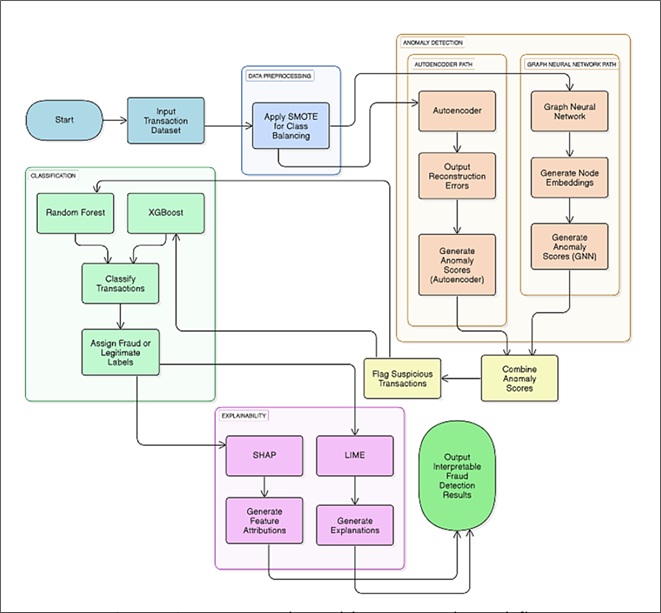

Detection of fraud in business has become increasingly significant with the intricacy and complexity of contemporary fraudulent schemes. This paper presents an exhaustive review of sophisticated approaches integrating machine learning, anomaly detection, and Explainable Artificial Intelligence (XAI) for improving fraud detection systems. Primary preprocessing methods like SMOTE resolve class imbalance, whereas models like Autoencoders and Graph Neural Networks (GNNs) detect anomalous patterns in large and complex datasets efficiently. Classification techniques, like Random Forest and XGBoost, show great performance in detecting fraudulent transactions. Correspondingly, the integration of XAI methods such as SHAP and LIME completes the gap in between accuracy and transparency, finding solutions in order to regulate compliance and attain confidence in automated systems. Recent advances including generative AI models and secure mechanisms have vowed to balance predictive ability and data privacy. Though these developments are underway, scalability, real-time deployment, and expansion to keep up with growing fraud patterns continue to be challenges. This work identifies emerging trends, recognizes key research gaps, and proposes a research plan for creating scalable, interpretable, and adaptive financial fraud detecting systems

References

[1] K. Koo, M. Park, and B. Yoon, “A suspicious financial

transaction detection model using autoencoder and risk-based

approach,” IEEE Access, Vol.12, pp.68926–68939, 2024.

https://doi.org/10.1109/ACCESS.2024.3399824

[2] S. Bisht, S. Sengupta, I. Tewari, N. Bisht, K. Pandey, and A.

Upadhyay, “AI-Driven Tools Transforming The Banking

Landscape: Revolutionizing Finance,” In the Proceedings of the

2024 10th International Conference on Advanced Computing and

Communication Systems (ICACCS), IEEE, pp.934–938, 2024.

[3] P. Sharma, A. S. Prakash, and A. Malhotra, “Application of

Advanced AI Algorithms for Fintech Crime Detection,” In the

Proceedings of the 2024 15th International Conference on

Computing Communication and Networking Technologies

(ICCCNT), IEEE, pp.1–6, 2024.

[4] G. Konstantinidis and A. Gegov, “Deep Neural Networks for Anti

Money Laundering Using Explainable Artificial Intelligence,” In

the Proceedings of the 2024 IEEE 12th International Conference

on Intelligent Systems (IS), IEEE, pp.1–6, 2024.

[5] T. H. Phyu and S. Uttama, “Enhancing Money Laundering

Detection Addressing Imbalanced Data and Leveraging

Typological Features Analysis,” In the Proceedings of the 2024

21st International Joint Conference on Computer Science and

Software Engineering (JCSSE), IEEE, pp.330–336, 2024.

[6] T. H. Phyu and S. Uttama, “Improving Classification

Performance of Money Laundering Transactions Using

Typological Features,” In the Proceedings of the 2023 7th

International Conference on Information Technology (InCIT),

IEEE, pp.520–525, 2023.

[7] C. Maree, J. E. Modal, and C. W. Omlin, “Towards responsible

AI for financial transactions,” In the Proceedings of the 2020

IEEE Symposium Series on Computational Intelligence (SSCI),

IEEE, pp.16–21, 2020.

[8] Z. Chen, W. M. Soliman, A. Nazir, and M. Shorfuzzaman,

“Variational autoencoders and Wasserstein generative adversarial

networks for improving the anti-money laundering process,”

IEEE Access, Vol.9, pp.83762–83785, 2021.

https://doi.org/10.1109/ACCESS.2021.3086359

[9] R. Desrousseaux, G. Bernard, and J. J. Mariage, “Profiling

money laundering with neural networks: A case study on

environmental crime detection,” In the Proceedings of the 2021

IEEE 33rd International Conference on Tools with Artificial

Intelligence (ICTAI), IEEE, pp.364–369, 2021.

[10] Z. Ereiz, “Predicting default loans using machine learning

(OptiML),” In the Proceedings of the 2019 27th

Telecommunications Forum (TELFOR), IEEE, pp.1–4, 2019.

https://doi.org/10.1109/TELFOR48224.2019.8971110

[11] H. N. Mohammed, N. S. Malami, S. Thomas, F. A. Aiyelabegan,

F. A. Imam, and H. H. Ginsau, “Machine learning approach to

anti-money laundering: A review,” In the Proceedings of the 2022

IEEE Nigeria 4th International Conference on Disruptive

Technologies for Sustainable Development (NIGERCON), IEEE,

pp.1–5, 2022.

[12] A. F. Mhammad, R. Agarwal, T. Columbo, and J. Vigorito,

“Generative & responsible AI-LLMs use in differential

governance,” In the Proceedings of the 2023 International

Conference on Computational Science and Computational

Intelligence (CSCI), IEEE, pp.291–295, 2023.

[13] E. Kurshan, H. Shen, and H. Yu, “Financial crime & fraud

detection using graph computing: Application considerations &

outlook,” In the Proceedings of the 2020 Second International

Conference on Transdisciplinary AI (TransAI), IEEE, pp.125–

130, 2020.

[14] A. El-Kilany, A. M. Ayoub, and H. M. El Kadi, “Detecting

Suspicious Customers in Money Laundering Activities Using

Weighted HITS Algorithm,” In the Proceedings of the 2024 5th

International Conference on Artificial Intelligence, Robotics and

Control (AIRC), IEEE, pp.112–117, 2024.

[15] K. Balaji, “Artificial Intelligence for Enhanced Anti-Money

Laundering and Asset Recovery: A New Frontier in Financial

Crime Prevention,” In the Proceedings of the 2024 Second

International Conference on Intelligent Cyber Physical Systems

and Internet of Things (ICoICI), IEEE, pp.1010–1016, 2024.

[16] D. Cheng, Y. Ye, S. Xiang, Z. Ma, Y. Zhang, and C. Jiang, “Anti-

money laundering by group-aware deep graph learning,” IEEE

Trans. Knowl. Data Eng., Vol.35, No.12, pp.12444–12457, 2023.

https://doi.org/10.1109/TKDE.2023.3272396

[17] D. V. Kute, B. Pradhan, N. Shukla, and A. Alamri, “Deep learning

and explainable artificial intelligence techniques applied for

detecting money laundering – A critical review,” IEEE Access,

Vol.9, pp.82300–82317, 2021.

https://doi.org/10.1109/ACCESS.2021.3086230

[18] D. V. Kute, B. Pradhan, N. Shukla, and A. Alamri, “Explainable

deep learning model for predicting money laundering

transactions,” Int. J. Smart Sens. Intell. Syst., Vol.17, No.1, 2024.

https://doi.org/10.2478/ijssis-2024-0027

[19] O. Kuiper, M. van den Berg, J. van der Burgt, and S. Leijnen,

“Exploring explainable AI in the financial sector: Perspectives of

banks and supervisory authorities,” In the Proceedings of the

Artificial Intelligence and Machine Learning: 33rd Benelux

Conference on Artificial Intelligence, BNAIC/Benelearn 2021,

Esch-sur-Alzette, Luxembourg, Nov. 10–12, 2021, Revised

Selected Papers, Springer International Publishing, Vol.33,

pp.105–119, 2022.

[20] D. Vijayanand and G. S. Smrithy, “Explainable AI-enhanced

ensemble learning for financial fraud detection in mobile money

transactions,” Intelligent Decision Technologies, Art. no.

18724981241289751, 2024.

[21] F. Xu, H. Uszkoreit, Y. Du, W. Fan, D. Zhao, and J. Zhu,

“Explainable AI: A brief survey on history, research areas,

approaches and challenges,” In the Proceedings of the Natural

Language Processing and Chinese Computing: 8th CCF

International Conference, NLPCC 2019, Dunhuang, China, Oct.

9–14, 2019, Part II, Springer International Publishing, Vol.8,

pp.563–574, 2019.

[22] R. Alhajeri and A. Alhashem, “Using Artificial Intelligence to

Combat Money Laundering,” Intelligent Information

Management, Vol.15, No.4, pp.284–305, 2023.

https://doi.org/10.4236/iim.2023.154014

[23] S. K. Hashemi, S. L. Mirtaheri, and S. Greco, “Fraud detection in

banking data by machine learning techniques,” IEEE Access,

Vol.11, pp.3034–3043, 2022.

https://doi.org/10.1109/ACCESS.2022.3232287

[24] E. R. Mill, W. Garn, N. F. Ryman-Tubb, and C. Turner,

“Opportunities in real time fraud detection: An explainable

artificial intelligence (XAI) research agenda,” International

Journal of Advanced Computer Science and Applications, Vol.14,

No.5, pp.1172–1186, 2023.

https://doi.org/10.14569/IJACSA.2023.01405121

[25] I. Psychoula, A. Gutmann, P. Mainali, S. H. Lee, P. Dunphy, and

F. Petitcolas, “Explainable machine learning for fraud detection,”

Computer, Vol.54, No.10, pp.49–59, 2021.

https://doi.org/10.1109/MC.2021.3081249

[26] J. Vidya Sagar and S. Aquter Babu, “A Hybrid Machine Learning

Approach for Real-Time Fraud Detection in Online Payment

Transactions,” Library Progress International, Vol.44, No.3,

pp.26067–26090, 2024.

[27] Anirban Majumder, “Intelligent AI Agents for Fraud and Abuse

Detection”, International Journal of Computer Science and

Engineering, Vol.12, Issue.4, pp.1-7, 2025.

[28] Avinash Malladhi, “Artificial Intelligence and Machine Learning

in Forensic Accounting”, International Journal of Computer

Science and Engineering, Vol.10, Issue.7, pp.15-21, 2023

Downloads

Published

How to Cite

Issue

Section

License

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors contributing to this journal agree to publish their articles under the Creative Commons Attribution 4.0 International License, allowing third parties to share their work (copy, distribute, transmit) and to adapt it, under the condition that the authors are given credit and that in the event of reuse or distribution, the terms of this license are made clear.