Central Bank Digital Currencies vs. Bitcoin: Competing or Complementary Digital Currencies?

DOI:

https://doi.org/10.26438/ijcse/v13i4.2333Keywords:

Bitcoin, Blockchain, Central Bank Digital Currency, Cryptocurrency, Decentralized Finance, Digital Currencies, Fiat-backed Digital Currency, Financial InclusionAbstract

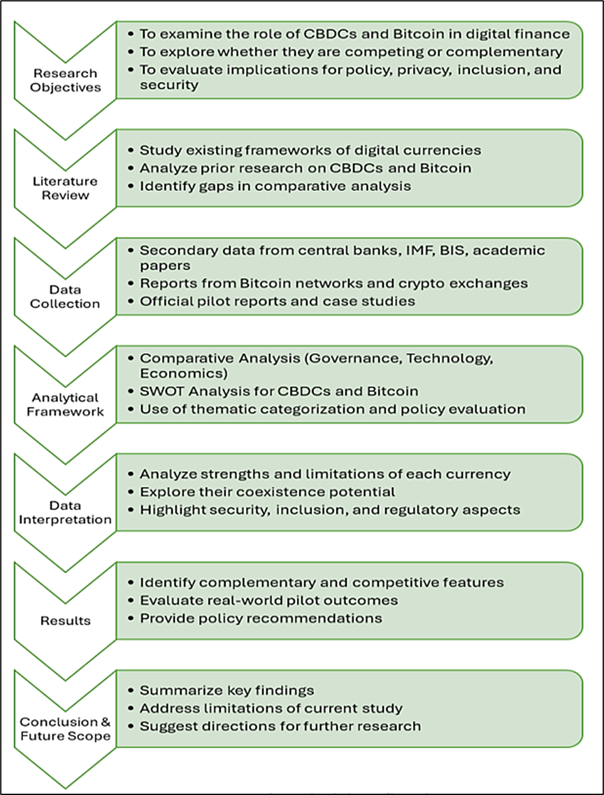

With the rapid digitization of finance, Central Bank Digital Currencies (CBDCs) and Bitcoin represent two distinct approaches to digital money. CBDCs are state-backed and regulated, whereas Bitcoin is decentralized and independent of government control. Understanding their interaction is crucial for policymakers, economists, and investors. This paper conducts a comprehensive SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis of both CBDCs and Bitcoin to evaluate their impact on the global financial landscape. The study explores the fundamental differences between these digital currencies, covering aspects such as monetary control, technological frameworks, regulatory challenges, and economic implications. The paper begins with an overview of related work, detailing various forms of money and existing comparative studies between CBDCs and Bitcoin. It then examines the structure, benefits, risks, and development of CBDCs, followed by an in-depth discussion on Bitcoin, including blockchain architecture, cryptographic protocols, and consensus mechanisms. Through a systematic SWOT analysis, the strengths of CBDCs—such as financial inclusion and transaction efficiency—are contrasted with their weaknesses, including privacy concerns and implementation costs. Similarly, Bitcoin’s decentralized nature and transparency are weighed against its volatility and regulatory uncertainty. Findings from this study highlight the need for balanced regulatory frameworks and technological innovations to maximize the benefits of both CBDCs and Bitcoin while mitigating associated risks. These insights contribute to ongoing discussions on the role of digital currencies in shaping the future of finance. The paper concludes with future research directions, emphasizing the importance of interoperability, scalability, and evolving security measures in the digital currency ecosystem. This research article will contribute to the ongoing debate on digital currencies, providing a balanced perspective on whether CBDCs and Bitcoin are rivals or complementary elements in the evolving financial landscape.

References

[1] M. Laboure, M. H.-P. Müller, G. Heinz, S. Singh and S. Köhling, “Cryptocurrencies and CBDC: The Route Ahead,” Global Policy, Vol.12, pp.663-676, 2021.

[2] S. Bernhart, “Applications of CBDCs and private stablecoins: Comparative analysis,” Northwestern Switzerland, 2020.

[3] Š. Jozipovi?, M. Perkuši? and N. Mladini?, “A Comparative Review of the Legal Status of National Cryptocurrencies and CBDCs: A Legal Tender or Just Another Means of Payment,” Pravni vjesnik: ?asopis za pravne i društvene znanosti Pravnog fakulteta Sveu?ilišta JJ Strossmayera u Osijeku, Vol.40, No.1, pp.77-96, 2024.

[4] F. Katherine, S. Blakstad, S. Gazi and M. Bos, “Digital Currencies and CBDC Impacts on Least Developed Countries (LDCs),” United Nations Development Programme and United Nations Capital Development Fund, 2021.

[5] P. Hamm, F. Tronnier and D. Harborth, “Can the Digital Euro Succeed where Bitcoin Failed? A Multigroup Comparison of Adoption Intention in Digital Currencies in Germany,” Pacific Asia Journal of the Association for Information Systems, Vol.17, No.1, pp.82-109, 2025.

[6] S. Nakamoto, Bitcoin: A Peer-to-Peer Electronic Cash System, 2008.

[7] S. Z. Ali, D. Sahu and J. Sahu, “Bitcoin in Blockchain: A Survey,” International Journal of Computer Sciences and Engineering, Vol.7, No.6, pp.708-712, 2019.

[8] D. W. Walumbe and J. G. Ndia, “A Systematic Literature Review of Proof of Work and Proof of Activity: Privacy and Performance,” International Journal of Computer Sciences and Engineering, Vol.11, No.10, pp.37-44, 2023.

[9] J. Campbell and V. Puri, “State of Bitcoin: 2024,” 17 December 2024.

Downloads

Published

How to Cite

Issue

Section

License

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors contributing to this journal agree to publish their articles under the Creative Commons Attribution 4.0 International License, allowing third parties to share their work (copy, distribute, transmit) and to adapt it, under the condition that the authors are given credit and that in the event of reuse or distribution, the terms of this license are made clear.