P2P Loan Management System Using Blockchain in 6G Network System

DOI:

https://doi.org/10.26438/ijcse/v12i5.6873Keywords:

Loan origination,, Transparency, Security, BlockchainAbstract

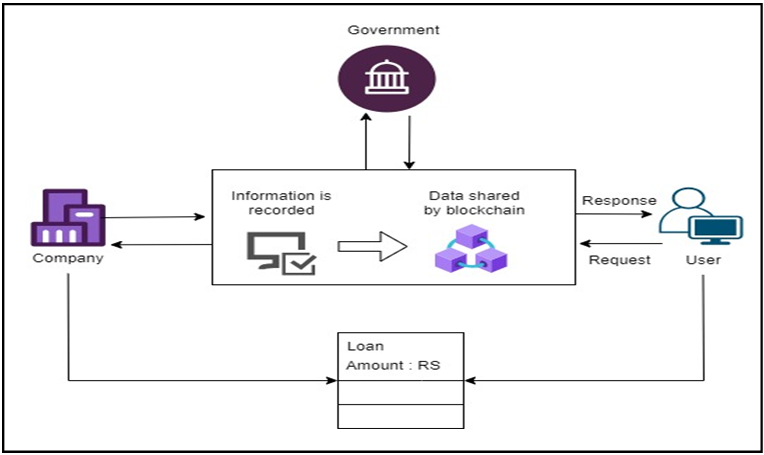

Decentralized, secure platform that aids in managing loan operations is the loan management system that uses blockchain technology. Through the use of blockchain`s distributed ledger technology, security, immutability, and transparency are guaranteed. The loan lifecycle may be managed with this system in an open and effective manner, from the point of loan application to loan payback. Every stage of the loan application process is documented on the blockchain, resulting in an irreversible and permanent record of all transactions. The loan management system automates a number of loan-related tasks, including loan application, credit evaluation, approval, and disbursal, by using smart contracts. This guarantees more accuracy and transparency, gets rid of the need for middlemen, and shortens processing times

References

[1] Adam Hahn and Rajveer Singh, “Smart contract-based campus demonstration of decentralized transactive energy auctions,” 17, 2018.

[2] Hiroki Watanabe and Jay Kishigami, “Blockchain Contract: Securing a block chain applied to Smart contracts,” 20,2018.

[3] Jiin– Chiou Cheng and Narn – Yih Lee, “Blockchain and Smart Contract for Digital certificate”, 21,2017.

[4] Maxim Ya. Afanasev and Yuri V. Fedosov, “An application of block chain and smart contracts for machine-to-machine communication”, May21,2017.

[5] S. Hema Kumar, J. Uday Kiran, V. D. A Kumar, G. Saranya, Ramalakshmi V, “Effective Online Medical Appointment System. International Journal of Scientific & Technology Research,” Vol 8, Issue 09, September 2019.

[6] Heffernan, Sh: “Modern Banking”, 2005.

[7] Arunkumar, R., Kotreshwar, G: “Risk Management in Commercial Banks”, December.2005.

[8] Matthews, K. and Thompson, J: "The Economics of Banking", 2005.

[9] Mckinley J., E., & Barrickman, J.R: "Strategic Credit Risk Management," Robert Morris Association, Philadelphia, 1994.

[10] Osayameh, R., “Banking practice: Lending and Finance,” Vol. 2, Lagos: F.A. Publishers, (1996).

[11] Ciuriak, D: "Applying the Best Banking Standards and Standards. - Lessons from the Past," March 2001, (revised February 2010).

[12] Saunders A, and Walter, I: “Financial Architecture Systemic Risk and Universal Banking,”Stern School of Business, New York University, New York, 2011.

Downloads

Published

How to Cite

Issue

Section

License

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors contributing to this journal agree to publish their articles under the Creative Commons Attribution 4.0 International License, allowing third parties to share their work (copy, distribute, transmit) and to adapt it, under the condition that the authors are given credit and that in the event of reuse or distribution, the terms of this license are made clear.