Improving Credit Risk Assessment in MSMEs: A Machine Learning-Based Approach

DOI:

https://doi.org/10.26438/ijcse/v11i7.2933Keywords:

Machine Learning,, Credit Risk Assessment, MSMEs, Risk Managemen, Financial Technology.Abstract

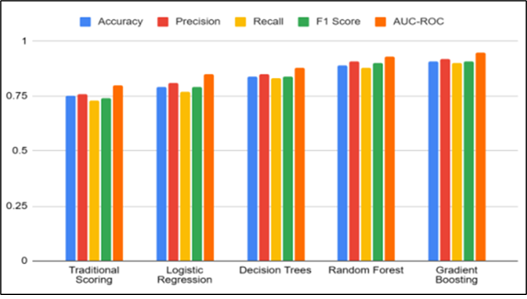

This paper delves into the utilization of machine learning (ML) to enhance the credit risk assessment of Micro, Small and Medium Enterprises (MSMEs). With the burgeoning digital economy and growing complexities in financial transactions, traditional methods for assessing credit risk are proving inadequate. The research aims to establish an ML model that will offer more accurate, reliable, and efficient credit risk assessment in the MSME sector. The model’s development, implementation, and performance are critically evaluated using real credit data from various banks.

References

[1] Ayyagari, M., Demirguc-Kunt, A., & Maksimovic, V. (2011). Small vs. Young Firms across the World: Contribution to Employment, Job Creation, and Growth. World Bank Policy Research Working Paper No. 5631. 2011.

[2] Beck, T., Demirguc-Kunt, A., & Maksimovic, V. (2005). Financial and Legal Constraints to Firm Growth: Does Size Matter? Journal of Finance, Vol.60, Issue.1, pp.137-177, 2005.

[3] Berger, A. N., & Udell, G. F. (2006). A more complete conceptual framework for SME finance. Journal of Banking & Finance, Vol.30, Issue.11, pp.2945-2966, 2006

[4] Bensic, M., Sarlija, N., & Zekic-Susac, M. (2005). Modelling small-business credit scoring by using logistic regression, neural networks, and decision trees. Intelligent Systems in Accounting, Finance & Management, Vol.13, Issue.3, pp.133-150, 2005.

[5] Bose, I., & Chen, X. (2009). Quantitative models for direct marketing: A review from systems perspective. European Journal of Operational Research, 195(1), pp.1-16, 2009.

[6] Lessmann, S., Baesens, B., Seow, H.V., & Thomas, L.C. (2015). Benchmarking state-of-the-art classification algorithms for credit scoring: An update of research. European Journal of Operational Research, 247(1), pp.124-136, 2015.

[7] Fawcett, T. (2006). An introduction to ROC analysis. Pattern Recognition Letters, 27(8), pp.861-874, 2006.

[8] Guyon, I., & Elisseeff, A. (2003). An introduction to variable and feature selection. Journal of Machine Learning Research, 3(Mar), pp.1157-1182, 2003.

[9] Kohavi, R. (1995). A study of cross-validation and bootstrap for accuracy estimation and model selection. Proceedings of the 14th International Joint Conference on Artificial Intelligence – Vol.2, 1995 (IJCAI’95).

[10] Kotsiantis, S. B., Kanellopoulos, D., & Pintelas, P. (2006). Data preprocessing for supervised leaning. International Journal of Computer Science, 1(2), pp.111-117, 2006.

[11] Abdou, H. A., & Pointon, J. (2011). Credit scoring, statistical techniques and evaluation criteria: a review of the literature. Intelligent Systems in Accounting, Finance and Management, 18(2-3), pp.59-88, 2011.

[12] Bholat, D., Brookes, J., Cai, C., Grundy, K., & Lund, J. (2020). Explainability in Machine Learning and its implications for Central Banking. Bank of England Staff Working Paper No. 875, 2020.

[13] Breiman, L. (2001). Random forests. Machine learning, 45(1), 5-32, 2001.

[14] Chen, T., & Guestrin, C. (2016, August). Xgboost: A scalable tree boosting system. In Proceedings of the 22nd ACM SIGKDD International Conference on Knowledge Discovery and Data Mining, pp.785-794, 2016.

[15] Demšar, J., Curk, T., Erjavec, A., Gorup, ?., Ho?evar, T., Milutinovi?, M., ... & Žagar, L. (2013). Orange: Data mining toolbox in Python. The Journal of Machine Learning Research, 14(1), pp.2349-2353, 2013.

[16] Friedman, J. H. (2001). Greedy function approximation: a gradient boosting machine. Annals of statistics, pp.1189-1232, 2001.

[17] Harris, C. R., Millman, K. J., van der Walt, S. J., Gommers, R., Virtanen, P., Cournapeau, D., ... & Oliphant, T. E. (2020). Array programming with NumPy. Nature, 585(7825), pp.357-362, 2020.

[18] Huang, J., Ling, C. X., & Li, Z. (2006, June). Use of mutual information for selecting features in supervised neural net learning. IEEE Transactions on Neural Networks, Vol.17, Issue.4, pp.879-890, 2006.

[19] Hunter, J. D. (2007). Matplotlib: A 2D graphics environment. Computing in science & engineering, Vol.9, Issue.3, pp.90-95, 2007.

[20] Waskom, M., Botvinnik, O., Ostblom, J., Lukauskas, S., Hobson, P., Gelbart, M., ... & Warmenhoven, J. (2021). seaborn: statistical data visualization. Journal of Open Source Software, 6(60), 2021.

Downloads

Published

How to Cite

Issue

Section

License

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors contributing to this journal agree to publish their articles under the Creative Commons Attribution 4.0 International License, allowing third parties to share their work (copy, distribute, transmit) and to adapt it, under the condition that the authors are given credit and that in the event of reuse or distribution, the terms of this license are made clear.