Pattern Recognition and Machine Learning Approach for Stock Trading Decisions: A Review

DOI:

https://doi.org/10.26438/ijcse/v11i6.1521Keywords:

Pattern, Candlestick,, ANN, CNN, Open, CloseAbstract

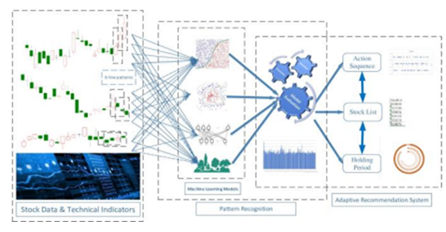

Stock Trading Decisions are important in selection of the right stock at the right time. There are traditional and regular methods for identifying superior stocks for investment but looking into volatility of current market scenario, new technologies must be incorporate to accomplish the target. Here, we presented a review on use of pattern recognition approach and machine learning techniques for Stock Trading Decisions. Usually common patterns are seen in the buying and selling data of stocks for a specific business house. Analysing these data patterns with the use of machine learning approach will produce a better result for Trading Decision. Different machine learning models has been built and applied by different authors to achieve better stock trading decisions.

References

[1] T. Fischer, C. Krauss, “Deep Learning With Long Short-Term Memory Networks for Financial Market Predictions”, European Journal of Operation Research, Vol. 270, No 2, pp.654-669, 2018.

[2] Ding, Xiao, Yue Zhang, Ting Liu, Junwen Duan, "Deep learning for event-driven stock prediction." In Proceedings of the Twenty-Fourth International Joint Conference on Artificial Intelligence (IJCAI 2015)”, pp.2327-2333, 2015.

[3] Hendrik. Bessembinder, Kalok Chan, "Market Efficiency And the Returns to Technical Analysis", Financial Management, pp.5-17, 1998.

[4] Ben R. Marshall, Martin R. Young, Lawrence C. Rose. "Candlestick Technical Trading Strategies: Can They Create Value for Investors?." Journal of Banking and Finance, Vol. 30, No 8, pp.2303-2323, 2006.

[5] T. H. Lu, "The Profitability of Candlestick Charting in the Taiwan Stock Market." Pacific-Basin Finance Journal, Vol. 26, pp. 65-78, 2014.

[6] T. H. Lu, Yi-Chi Chen, Yu-Chin Hsu. "Trend Definition or Holding Strategy: What Determines The Profitability of Candlestick Charting?.", Journal of Banking & Finance, Vol. 61, pp. 172-183, 2015.

[7] Min. Zhu, Said Atri, Eyub Yegen, "Are Candlestick Trading Strategies Effective in Certain Stocks With Distinct Features?”, Pacific-Basin Finance Journal, Vol.37, pp. 116-127, 2016.

[8] Shi Chen, Si Bao, Yu Zhou, "The Predictive Power of Japanese Candlestick Charting In Chinese Stock Market", Physica A: Statistical Mechanics and its Applications, Vol. 457, pp. 148-165, 2016.

[9] J. Fock, Henning, Christian Klein, Bernhard Zwergel. "Performance of Candlestick Analysis on Intraday Futures Data", The Journal of Derivatives, Vol. 13, No 1, pp. 28-40, 2005.

[10] Matthieu Duvinage, Paolo Mazza, Mikael Petitjean, "The Intra-Day Performance of Market Timing Strategies And Trading Systems Based on Japanese Candlesticks." Quantitative Finance, Vol. 13, No 7, pp. 1059-1070, 2013.

[11] Marc`Aurelio Ranzato, Y-Lan Boureau, Yann Cun. "Sparse Feature Learning for Deep Belief Networks", Advances In Neural Information Processing Systems, Vol. 20, 2007.

[12] Yaohu Lin, ,Shancun Liu, Haijun Yang, Harris Wu, Bingbing Jiang, "Improving Stock Trading Decisions Based on Pattern Recognition Using Machine Learning Technology", PloS one, Vol. 16, No. 8, 2021.

[13] Marc Velay, Fabrice Daniel, "Stock Chart Pattern Recognition With Deep Learning." arXiv preprint arXiv:1808.00418 , 2018.

[14] D. Sorna Shanthi, T. Aarthi, A.K. Bhuvanesh, RA. Chooriya Prabha,"Pattern Recognition in Stock Market”, International Journal of Computer Science and Mobile Computing, Vol. 9, No 3, pp.106 – 111, 2020.

[15] Li. Yawei, Liu. Peipei, Wang. Ze, "Stock Trading Strategies Based on Deep Reinforcement Learning", Scientific Programming, Vol. 2022, pp. 1-15, 2022. https://doi.org/10.1155/2022/4698656

[16] A. HhUpreti, A. Agrawal, J. K. Joshi, S. Seniaray,(2022). “Quantitative Study of Candlestick Pattern & Identifying Candlestick Patterns Using Deep Learning For The Indian Stock Market”, International Journal of Health Sciences, Vol. 6 No S3, pp. 5739–5749, 2022.

[17] Üzeyir AYCEL, Yunus SANTUR, "A New Algorithmic Trading Approach Based on Ensemble Learning And Candlestick Pattern Recognition in Financial Assets", Turkish Journal of Science and Technology, Vol. 17, No 2, pp. 167-184, 2022.

[18] Ni Putu Winda Ardiyanti, Irma Palupi, Indwiarti Indwiarti. "Trading Strategy On Market Stock By Analyzing Candlestick Pattern Using Artificial Neural Network (Ann) Method", Journal Media Informatika Budidarma,Vol. 5, No 4, pp. 1273-1282, 2021.

[19] T, T. Ho, Y. Huang, “Stock Price Movement Prediction Using Sentiment Analysis And Candlestick Chart Representation”, Sensors, Vol. 21, No 23, pp. 7957, 2021.

[20] U. GOKUL, “Forecast Share Price Using Technical Analysis Tool”, Pacific International Journal, Vol. 4, No 1, pp. 01-06, 2021.

[21] J. H. Chen, Y. C. Tsai, “Encoding Candlesticks As Images For Pattern Classification Using Convolutional Neural Networks”, Financial Innovation, Vol. 6, No 1, pp. 1-19, 2020.

Downloads

Published

How to Cite

Issue

Section

License

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors contributing to this journal agree to publish their articles under the Creative Commons Attribution 4.0 International License, allowing third parties to share their work (copy, distribute, transmit) and to adapt it, under the condition that the authors are given credit and that in the event of reuse or distribution, the terms of this license are made clear.