Simulation Based Exploration of Stock Market Using LSTM Model

DOI:

https://doi.org/10.26438/ijcse/v11i4.2629Keywords:

Stock Market, Predicting, LSTM Model,, RNN Model, Prices, Complex Data, DensityAbstract

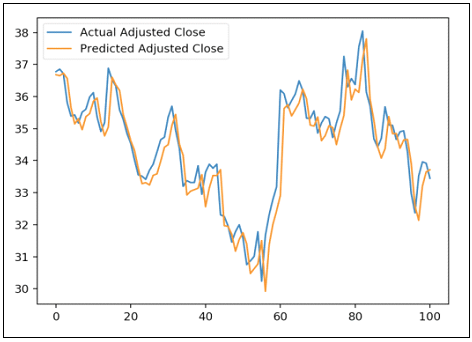

In today’s world the stock market has a huge impact on the economy making it difficult for stock market investors to predict stock prices. Financial market investors cannot use simple models to more accurately predict stock prices to invest in stocks. Deep learning helps computer to solve complex problems which humans takes more time to solve. This paper is based on developing a model to predict inventory value using recurrent neural network (RNN) and long- short term memory model (LSTM).

References

[1] A S Pradeep, Soren Goyal and M. Miller, “Detection of statistical arbitrage using machine learning techniques in Indian Stock market”, PhD Thesis, Computer Science Department, IIT Kanpur, 2019.

[2] Dhiraj Mundada, Gaurav Chhaparwal, Sachin Chaudhari, Trupti Bhamare, “Stock Value Prediction System”, International Journal on Recent and Innovation Trends in Computing and Communication, Vol. 3, Issue 4, pp. 2217 - 2219, 2015. https://doi.org/10.17762/ijritcc.v3i4.4214

[3] Rakhi Mahant, Trilok Nath Pandey, Alok Kumar Jagadev and, Satchidananda Dehuri, “Optimized Radial Basis Functional Neural Network for Stock Index Prediction”, International Conference on Electrical, Electronics, and Optimization Techniques (ICEEOT), Vol. 7, Issue 11, pp. 1252 - 1257, 2016. Doi: 10.1109/ICEEOT.2016.7754884

[4] S. Hochreiter and J. Schmid Huber, “Long Short- Term Memory”, Neural Computation, Vol.9, Issue 8, pp. 1735 - 1780, 1997. https://doi.org/10.1162/neco.1997.9.8.1735

[5] S. Sarode, H. G. Tolani, P. Kak and C. S. Lifna, "Stock Price Prediction Using Machine Learning Techniques”, International Conference on Intelligent Sustainable Systems (ICISS), Vol 5, Issue 3, pp. 177 - 181, 2019. Doi: 10.1109/ISS1.2019.8907958.

Downloads

Published

How to Cite

Issue

Section

License

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors contributing to this journal agree to publish their articles under the Creative Commons Attribution 4.0 International License, allowing third parties to share their work (copy, distribute, transmit) and to adapt it, under the condition that the authors are given credit and that in the event of reuse or distribution, the terms of this license are made clear.